None of us is ever certain of the things to come in every single day. Thus, as an insurance agent or broker, have you ever thought about how you can better educate people on the importance of insurance coverage in their lives?

More importantly, do you know the latest Insurance Agency Marketing Trends to help you grow your insurance practice this year? We got these eleven tips for you…

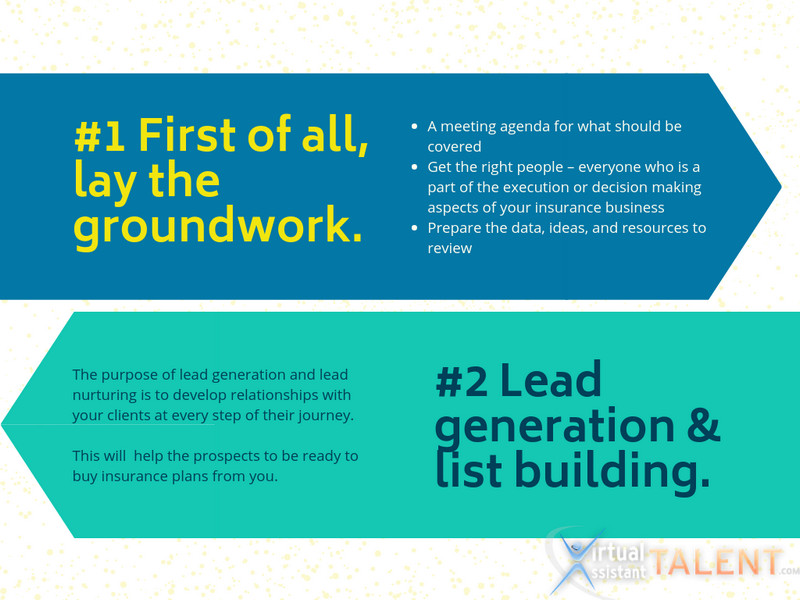

1. First of all, lay the groundwork.

The best insurance marketing campaigns always start with a plan. It’s like a new year’s resolution that in order to move forward, your team should regroup and dedicate a time to map out marketing efforts for the whole year:

- A meeting agenda for what should be covered

- Get the right people – everyone who is a part of the execution or decision making aspects of your insurance business

- Prepare the data, ideas, and resources to review

Questions that your team needs to discuss:

- Where is your insurance agency’s marketing at a glance?

- What do you want to achieve – what’s the purpose of your marketing?

- What worked and did not work this past year?

2. Lead generation, lead nurturing, and list building.

You already know a lead is anyone who has shown interest in your insurance services. It could be requesting a quote or asking more about what you can offer. Thus, lead generation and nurturing is a systematic process of attracting and converting prospects into sales.

The purpose of this list building activity is to develop relationships with your leads at every step of the client journey. This will also help the prospects to be ready to buy insurance plans from you.

Clients who receive two or more proactive contacts from their agency per year are 10% more likely to stick with their current agency. Click To Tweet3. Analyze your winning capacity.

No one wants his or her business to flunk no matter what. The types of people who will win and achieve their goals are those who are willing to research, listen, invest, and try new things. Working with an Insurance Agent Virtual Assistant allows you to do just like that.

You don’t have to be a digital marketing expert in this new generation because a VA can assist you with finding the right prospects and creating a custom experience for your clients. You just have to be willing to go full speed ahead and put in the work.

4. Proactively seek marketing touchpoints with your clients.

If you constantly search for insurance marketing ideas, you will need to come up with techniques to engage more with your audience. To demonstrate the value and advocacy you provide as an insurance agent, connect with your clients often times rather than just before policy renewal periods.

Insurance Agents who average two or more contacts per year with their customers are growing 55% more than their counterparts who are not making contact with their customers. Click To Tweet

5. Videos and SEO are important for online presence

Many marketers recognize Search Engine Optimization (SEO) as one of the most regularly updating components of digital marketing. And video is still dominating the social media sphere.

You need this all to grow and maintain strong organic traffic and page ranking results. But what if you find it hard to get down the nitty-gritty of SEO algorithms and processes? That’s where an SEO Virtual Assistant comes in.

An SEO VA can optimize your website pages to have quality content, equipped with the most significant and relevant keywords, backlinks, and improve your search ranking.

72% of people would rather use video to learn about a product or service, and 81% have been convinced to buy a product or service by watching a brand’s video. ~ Wyzowl survey Click To Tweet6. Excellent customer experience must be a priority.

How can insurance agents adapt when many are expecting 24/7 access to service? There are two huge resources available to you: outsourcing to customer service centers and digital self-service options.

The majority of customer transactions are billing and inquiry related. Thus, through customer service support agents and online apps, clients can easily view policy documents online, report a claim, or pay their dues.

7. People do pay attention to the weight of testimonials.

The majority of these insurance trends revolve around trust and authenticity—two of the most reliable factors you should develop in order to succeed in the industry.

Online reviews and testimonials are so powerful that prospects will effortlessly trust others’ feedback than the information displayed by your agency.

8. Be a widespread insurance resource through valuable content.

Blog articles are key to effective content marketing if you wish to grow from simply an insurance agent to a proven expert on insurance-specific issues. But if you think you can’t just set aside time to write blogs, then hire a freelance content writer.

Have him or her research and write about what you know best, but keep in mind that the objective is how to create value for your audience and not selling your services just yet. Make your clients participate in the topics and give them what they need.

9. Selectively and strategically partner with carriers.

Insurance agents who are more strategic about their carrier partners and work with fewer than seven carriers have a growth rate 53% higher than agents with more than seven carriers. Click To TweetThey also experience higher retention rates, higher average account premium and improved account rounding. Those agencies that go for select carriers that are committed to customer and agency needs experience greater satisfaction and results.

10. Collecting and studying social media data for future campaigns.

Conduct an A/B testing or create an Insurance Agency sample marketing plan to track, measure, and implement new findings for your social presence.

For both insurance agencies and brokers, social media can be the way to show a more caring and human side. A more personalized customer service by being accessible for clients on Facebook or LinkedIn, and answering promptly if someone sends you a question.

ComScore claims that close to 50% of all searches will be made through voice search by 2020. Click To Tweet11. Deep understanding of your performance.

The Hanover is able to conduct a multi-year analysis for independent agent partners in several key areas such as perspective on how they are performing, the execution of their strategy (many agents are surprised that their operations are not performing as they would expect), and benchmarks against their peer agents that are best in class in their revenue category.

Working on your insurance selling strategies to meet your 2019 goals can be easier and more effective if you leverage the right tools and resources. As always, move forward with the action items and let others talk about how great you are—so you will establish trust with your clients and eventually grow your practice/agency.

Our Insurance Agents Virtual Assistants (VA) can help with appointment setting, prospecting, telemarketing, and customer service so you can focus more time on growth, while your clients are receiving the support they need and are taken care of including nights and weekends.

Virtual Assistant Talent is the leading VA for hire services provider since 2009, helping professionals from different industries such as the real estate, insurance, small business, coaching/consulting, and executive leadership.

CALL US at 1-866-596-9041 and discover how our highly qualified and trained virtual assistants can help in your everyday tasks and objectives.

Reference:

www.inbuzzgroup.com

blog.easecentral.com

www.propertycasualty360.com